Commercial Crime Form: Protecting Safes and Business Assets

Businesses, regardless of size, are vulnerable to crimes such as theft, fraud, and forgery. These risks can compromise not only physical assets like safes and cash but also the financial stability of a business. A commercial crime form offers essential coverage designed to protect businesses from losses caused by criminal acts, both internal and external.

This article explores how commercial crime forms work, the protection they provide for safes and other assets, and why they’re a critical part of a comprehensive risk management strategy.

What Is a Commercial Crime Form?

A commercial crime form is a type of insurance policy designed to protect businesses from financial losses resulting from criminal activities. These activities include employee dishonesty, forgery, theft, fraud, and robbery.

Key Features

- Employee Dishonesty Coverage: Protects against theft or embezzlement by employees.

- Third-Party Theft Protection: Covers losses caused by burglars, robbers, or hackers.

- Forgery and Alteration: Insures against forged checks or fraudulent documents.

- Protection for Safes and Other Assets: Specifically covers safes, vaults, cash, securities, and inventory.

How Does a Commercial Crime Form Protect Safes?

Safes and vaults are critical for securing cash, documents, and valuables, but they’re not immune to theft or tampering. A commercial crime form provides coverage tailored to safeguard these assets in the following ways:

Theft Coverage

- External Theft: Protects against burglaries or robberies targeting safes.

- Internal Theft: Covers employee theft of cash or valuables stored in safes.

Robbery and Burglary Protection

- Covers forced entry into safes or vaults.

- Includes losses from armed robberies or attempted break-ins.

Safe and Lock Replacement

- Covers the cost of replacing or repairing damaged safes, locks, or vaults after an incident.

Money and Securities Coverage

- Protects cash, checks, and financial documents stored in safes from theft or destruction.

Cybercrime and Fraud Protection

For businesses using electronic safes or smart vaults, commercial crime forms can cover losses caused by hacking or unauthorized access.

Why Do Businesses Need a Commercial Crime Form?

Commercial crime forms are essential for safeguarding against a wide range of risks that can lead to significant financial losses.

Protection Against Employee Dishonesty

- Employee theft is one of the most common risks businesses face, especially for companies handling large amounts of cash.

Coverage for Physical and Digital Crimes

- Modern businesses face threats from both physical theft and cyberattacks. A crime form covers both scenarios.

Financial Stability

- Recovering from theft or fraud can strain a company’s finances. Crime insurance ensures that businesses remain stable after an incident.

Peace of Mind

- Knowing that safes and other critical assets are insured allows business owners to focus on growth rather than security concerns.

What’s Covered Under a Commercial Crime Form?

Here’s a breakdown of typical coverages included in a commercial crime form:

| Coverage | Description |

| Employee Theft | Covers theft of cash, securities, or property by employees. |

| Forgery and Alteration | Protects against forged checks or tampered financial documents. |

| Burglary and Robbery | Covers physical theft involving safes, vaults, or business premises. |

| Theft of Money/Securities | Insures cash, checks, or valuable securities from theft, destruction, or disappearance. |

| Computer Fraud | Covers losses caused by hacking or unauthorized access to financial systems. |

| Funds Transfer Fraud | Protects against fraudulent electronic transfers initiated by criminals. |

How to Choose the Right Commercial Crime Form

Selecting the best crime insurance for your business involves evaluating your unique risks and operational needs.

Assess Your Business Risks

- Identify areas vulnerable to theft, fraud, or dishonesty, such as safes, cash handling, or digital transactions.

Verify Policy Limits

- Ensure the coverage limits are sufficient to cover the total value of assets stored in safes and other critical areas.

Include Cybercrime Coverage

- Opt for policies that cover digital threats like hacking, especially if your business uses smart safes or electronic security systems.

Understand Exclusions

- Review what the policy doesn’t cover, such as damages from natural disasters or pre-existing vulnerabilities.

Work with a Trusted Insurance Provider

- Partner with an insurer experienced in commercial crime policies to tailor a solution for your business.

Best Practices for Protecting Safes and Assets

While a commercial crime form provides critical coverage, proactive security measures can help minimize risks:

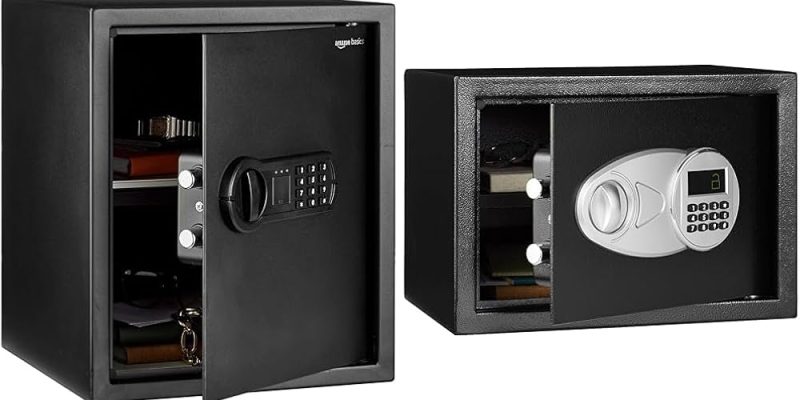

Invest in High-Quality Safes

- Choose safes with advanced security features, such as biometric access or time-delayed locks.

Implement Employee Screening

- Conduct thorough background checks and establish clear policies for cash and asset handling.

Install Surveillance Systems

- Use CCTV cameras to monitor safes and surrounding areas, deterring theft.

Conduct Regular Audits

- Perform regular inventory and cash audits to identify discrepancies early.

Train Employees on Security Protocols

- Educate staff about recognizing fraudulent activities and following safe practices.

Conclusion

A commercial crime form is a vital tool for protecting safes and other business assets from theft, fraud, and dishonesty. By combining robust insurance coverage with proactive security measures, businesses can minimize financial losses and operate with peace of mind.

Whether you’re a small business handling cash transactions or a large enterprise managing complex assets, investing in a commercial crime policy is a smart step toward safeguarding your operations.

Ready to protect your business? Explore commercial crime forms today and secure your assets against unexpected threats!

FAQs

1. What is a commercial crime form?

A commercial crime form is an insurance policy that protects businesses from financial losses caused by theft, fraud, forgery, and similar crimes.

2. Does a commercial crime form cover safes?

Yes, it covers safes, vaults, and the assets stored within them, such as cash, securities, and valuables.

3. Are employee thefts covered under a commercial crime form?

Yes, employee dishonesty or theft is typically covered under a commercial crime form.

4. How much does a commercial crime form cost?

The cost varies depending on factors like the size of the business, coverage limits, and specific risks.

5. Can it cover cyber-related crimes?

Many commercial crime forms include coverage for cybercrimes like hacking or unauthorized access, especially for digital safes.

Also read: Botswana Safari: 10 Stunning Photographic Spots for Nature Lovers