Most Prestige Credit Card: The Ultimate Luxury Cards of 2024

What Makes a Credit Card Prestigious?

Not all credit cards are created equal. The most prestigious credit cards offer unmatched luxury, elite rewards, and VIP services that cater to high-net-worth individuals (HNWIs).

- Exclusive access to luxury perks

Invitation-only memberships

Personal concierge services & elite travel benefits

No preset spending limits

These cards are not just about spending power—they represent wealth, status, and privilege. Let’s explore the top prestigious credit cards and what makes them so desirable.

The Most Prestige Credit Card in the World

American Express Centurion Card (“Black Card”)

- By Invitation Only – Reserved for ultra-high-net-worth individuals

No Preset Spending Limit – Unlimited purchasing power

24/7 Centurion Concierge – Personal shopping, reservations, and travel planning

Elite Travel Perks – Complimentary private jet access, 5-star hotel upgrades, and luxury airport lounges

Annual Fee: $5,000 + $10,000 initiation fee

Who Qualifies? Must spend at least $250,000 per year on an existing Amex card

The Amex Centurion Card is the ultimate prestige credit card—used by celebrities, CEOs, and billionaires worldwide.

J.P. Morgan Reserve Card (Formerly Palladium Card)

- Solid Palladium & Gold Design – Weighs over 27 grams

Exclusive to J.P. Morgan Private Bank Clients

Best-in-Class Travel & Concierge Services

No Foreign Transaction Fees & Premium Insurance Coverage

Annual Fee: $595

Who Qualifies? Must have $10M+ in assets with J.P. Morgan Private Bank

A rare and ultra-exclusive card, available only to the financial elite.

Dubai First Royale Mastercard

- 24K Gold Trim & Embedded Diamond – A true status symbol

No Preset Spending Limit – Infinite purchasing power

Dedicated Relationship Manager – Personalized financial services

Luxury Perks – Private chauffeurs, jets, and VIP event access

Annual Fee: Undisclosed

Who Qualifies? By invitation only for ultra-high-net-worth individuals in the UAE

This card is designed for royalty, billionaires, and global elites.

Stratus Rewards Visa (The White Card)

- Exclusive to High-Net-Worth Individuals & Celebrities

Private Jet Access & Personal Concierge

Luxury Travel & Lifestyle Experiences

Elite Shopping & Dining Privileges

Annual Fee: $1,500

Who Qualifies? By invitation only, requires a high level of spending

Unlike the “Black Card,” this is the rare White Card, known for its VIP treatment and celebrity clientele.

Coutts Silk Card (UK Exclusive)

- Issued by the Bank of the British Royal Family

Personalized Concierge & Exclusive Events

No Preset Spending Limits

Luxury Travel & Dining Privileges

Annual Fee: Undisclosed

Who Qualifies? Must have £1M+ in assets with Coutts Bank

This is the prestige card of choice for UK royalty and top executives.

What Perks Do Prestige Credit Cards Offer?

| Feature | Benefit |

| Elite Concierge Service | 24/7 personal assistant for reservations, shopping, and travel |

| Luxury Travel Rewards | VIP airport lounges, private jets, 5-star hotel upgrades |

| High Credit Limits | No preset spending limits for ultra-high purchases |

| Exclusive Event Access | Invitations to private galas, fashion shows, and red-carpet events |

| Premium Insurance Coverage | Global travel, medical, and purchase protection |

The most prestigious credit cards offer unparalleled luxury and financial flexibility.

How to Qualify for a Prestige Credit Card

Getting a prestigious credit card isn’t easy. Here’s what you need:

- High Annual Spending – Some require $250,000+ per year in charges

Private Banking Relationship – Many are exclusive to private bank clients

Excellent Credit Score (750+ FICO) – Essential for approval

By Invitation Only – Some require a personal invite from the bank

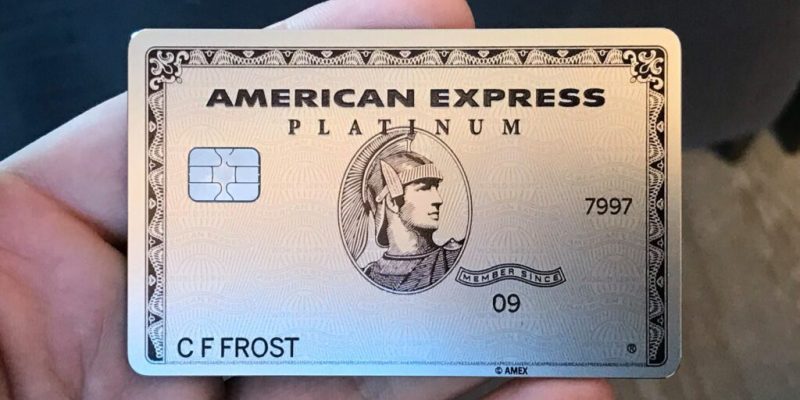

If you don’t qualify yet, start by using high-limit travel cards like the Amex Platinum or Chase Sapphire Reserve.

The Most Exclusive Credit Card in the World: Which One Wins?

The most prestigious credit card depends on your wealth and lifestyle needs:

- Best for Ultra-Wealthy Clients: Amex Centurion Card (High spending power)

Best for Private Bank Clients: J.P. Morgan Reserve Card

Most Luxurious Design: Dubai First Royale Mastercard (24K gold & diamond embedded)

Most Exclusive in the UK: Coutts Silk Card

For most people, the Amex Centurion remains the ultimate prestige credit card, offering luxury, status, and financial power.

Conclusion

- Prestige credit cards are more than just payment tools—they’re symbols of wealth and status.

If you qualify, you’ll enjoy unmatched luxury perks, VIP experiences, and unlimited spending power.

If you’re working toward a high-end card, start with premium travel cards and build your credit profile.

Do you dream of owning a prestige credit card? Which one would you choose? Let us know in the comments!

FAQs

1. What is the hardest credit card to get?

The Amex Centurion (Black Card) and Dubai First Royale require invitation-only access and extremely high spending.

2. What credit card do billionaires use?

Many billionaires use J.P. Morgan Reserve, Amex Centurion, or private banking-exclusive cards.

3. Can I apply for a prestige credit card?

Some, like Amex Platinum, allow direct applications, but others are invitation-only.

4. Is a prestige credit card worth it?

If you travel frequently and spend six figures annually, the perks outweigh the fees.

5. What is the best alternative to a prestige card?

Amex Platinum or Chase Sapphire Reserve offer high rewards and elite travel perks without requiring private banking.

Also read: When to Send Out Holiday Cards: The Perfect Timing for Every Occasion